About IDFC Bank :-

IDFC Bank Ltd. is an Indian banking company with headquarters in Mumbai that forms part of IDFC, an integrated infrastructure finance company. The bank started operations on 1 October 2015.

IDFC Bank has become all modern now, They have started opening Savings Bank account online within 5 minutes through eKYC, where they verify your identity by sending an OTP to your Registered Aadhar Mobile Number & moreover, you can get all banking facilities from them such as Debit cum ATM Card, Fund transfer, insurance, Recurring Deposit, etc.

About BookMyShow Offer :-

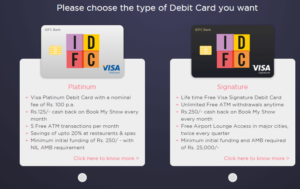

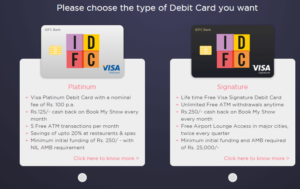

IDFC Bank is offering Rs 125 off BookMyShow Discount every month with their Platinum VISA Card, and Rs 250 off with their Signature VISA Card. You can open a Zero Balance Account online & order your Platinum VISA Card by just funding your account for atleast Rs 250 or more.

If you use your IDFC Bank’s Platinum/Signature Card online for booking your movie ticket on BookMyShow, then you will get Rs 125/Rs 250 Cashback Respectively on your booking. Cashback to eligible customers will be processed by IDFC Bank into customer’s bank account by 15th of next calendar month.

Bookmyshow offer source – Click here

Benefits of IDFC Bank Account :-

- Zero Balance Fully functional Savings Bank Account

- Rs 125 Bookmyshow Discount every Month

- VISA powered ATM cum Debit Card

- 5 Free ATM Withdrawl every Month

- 4% Intrest Per Month

- Fuel Surcharge Wavier

- Insurance Cover on your Debit card

- Free of cost Fund Transfer & Bill Payments

- Many More IDFC Bank Offers & benefits

Requirements to Open IDFC Bank Account?

- Aadhar Card Number

- PAN Card Number

- OTPs Sent to your number

That’s it 🙂

How to Open IDFC Bank Account Online?

- Visit IDFC Bank Online Registration page

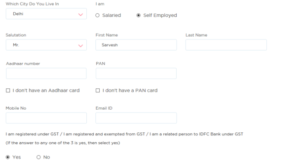

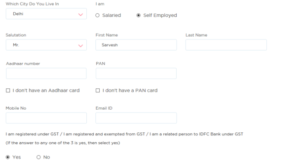

- Scroll bit down & Start filling the form you see on your screen with your relevant personal details

Note: Select City as Mumbai, Delhi, Bangalore, Chennai, Ahmedabad, Noida, Thane, Navi Mumbai only

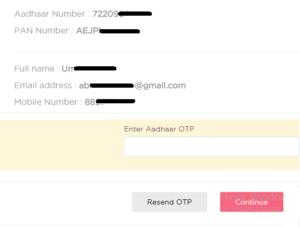

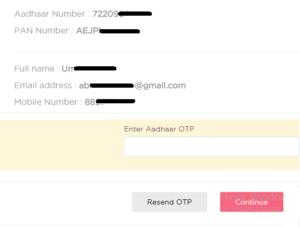

- Enter your Aadhar Number & PAN Number (Must for the Account to Open)

- Agree to the Terms & Conditions & Continue to next page

- Now you will receive an OTP on your Aadhar linked Mobile Number

- Enter the OTP to complete your eKYC process

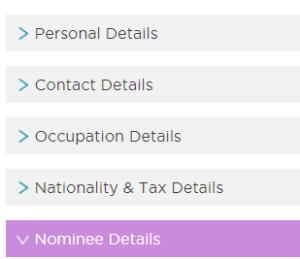

- Once Completed, Proceed further & Enter your Contact Details, Occupation Details, Nationality & Tax Details, Nominee Details (Optional)

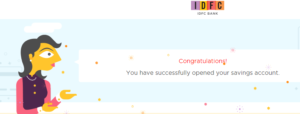

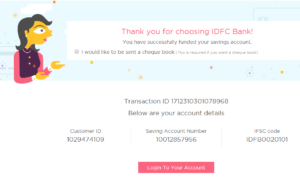

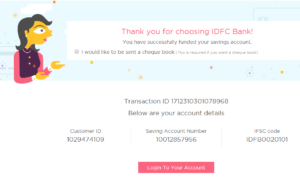

- That’s it! Your IDFC Bank Savings Account has been opened, You will get your Customer ID, Account Number & IFSC Code on your screen

- Now select your Preferred Debit Card (Select Platinum Card)

- Choose your desired name on your card & Fund your account with minimum Rs 250 to get your Card delivered at your address.

- Once you funded, you can also apply for a cheque book too (Optional)

How to Login to your IDFC Bank Account?

- Visit IDFC Bank Login page from here

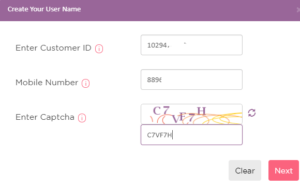

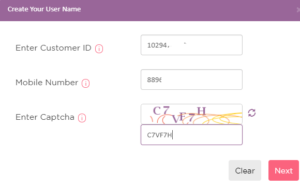

- If you havn’t generated your Username & Password then click on ‘Create Your User Name‘ Option

- Enter your Customer ID & Mobile Number > Enter Captcha > Next

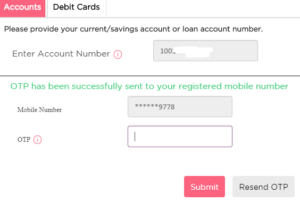

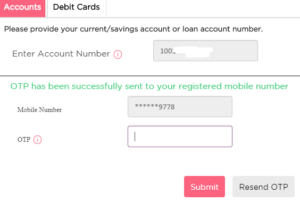

- Now You will be asked to Enter your Account Number > Submit

- Confirm your Identity by the OTP Sent to your

- Now create your Username & Password

- Once created, You can now login to your account!