Instant Credit Card Approval

Instant Credit Card Approval – You must have heard about credit cards but the bank does not provide that card to everyone because credit cards provides you the seamless possibility to make purchases, balance transfers and/or cash advances and requiring that you pay back the loan amount in the future. Unlike Debit cards where you can only use the amount you already have in your bank account.

It turns out that there can be many problems, including the formulation of goals, discipline, and even skepticism in the issue of money saving. We gave simple but effective advice on how to get rid of loans, save money, and create a budget “airbag.”

Credit cards have a certain limit fixed by the bank, you can only withdraw that much amount only. Moreover, there are always great reward offers running on Credit Cards, you may also use them to buy products on EMIs easily, sites like amazon, flipkart offers No Cost EMIs also. So you are not burdened to pay the huge interests normally a bank/ loan provider charges.

When using a credit card, you will need to make at least the minimum payment every month by the due date on the balance. If the full balance for purchases is not paid off, interest charges will be applied. Interest charges will be applied from the date of the transaction for balance transfers and/or cash advances.

So Credit cards are great and have more advantages than its cons. But while using a credit you always make sure to keep checking the transactions, sometimes companies like insurance sector companies directly call you and ask to get a insurance, they automatically activate such service & you would be charged monthly for it.

Moreover, if you pay the minimum amount every month (30-45 days cycle depends on the bank), then bank will not charge interest, but if you doesn’t pay the minimum amount the bank would start charging interest on it which is every high on credit cards.

Also See– Vova App Freebies Loot- Get Free Headphones, Speaker & More

Money Saving Tips for Couples :-

Keep a detailed account of expenses and make an analysis. Develop useful habits to highlight priority areas without which it is impossible to do and abandon unnecessary spending. Plan the spending of money according to the received funds. Learn to save for unforeseen expenses so as not to take loans during a crisis if you lose your job or need treatment.

Abandon loans. You may know that the debt payment increases the burden on your budget. Determine your priority needs and bring them in line with the income. Thus, you can reduce spending. Count on the money that has already been earned. It is nice and easy to spend money from a credit card, but don’t forget that it must be returned. Loans can help you reach your goal, but you can always save up for your plans and not overpay a bank for a loan. Also, you should repay loans with the highest interest rate because they are the most expensive.

Make a food-plan for the month. Prepare a diet for a week and make purchases on the list. Thus, you won’t have excess food and prevent its rottenness. You can buy at wholesale prices necessary products that are consumed by people in large quantities and don’t rot for a long time. This is the way to save.

Avoid going to restaurants and cafes. Prepare homemade food for family members and guests.

Avoid visits to spas and the gym. Do home procedures and avoid paid fitness classes – morning jogging and home exercises will help you.

Replace rest on exotic resorts to excursions in the neighboring region. You can replace expensive exhibitions and museums by a picnic in the park.

Don’t buy ready-made food and semi-finished products in the supermarkets. Instead of packaged goods, purchase cheaper weight food products.

Don’t go to stores when you are hungry. Also, don’t do this after receiving a salary but spend money after planning a budget. Go to the supermarket with a prepared list of products and, in order not to buy unnecessary trifles, visit only those departments where the necessary goods are located.

Periodically review the tariff plans for telephony. Choose only advantageous tariffs, which include the necessary options. There is no need to pay for functions you don’t use.

Quit bad habits. When analyzing costs, you may find that the cost of smoking and buying beer is quite high. A lot of money is spent on the purchase of chips, Coca-Cola, alcohol, and so on. Reducing these costs, you will save money and also preserve health. Rejecting them will help compensate for the lack of funds.

Use a method of five envelopes. It is designed for four weeks of the month. The entire salary is divided into five parts. Control of spending money occurs through the implementation of the rule – it is allowed to use the contents of only one envelope in a week. The fifth envelope is provided for the remaining last days in the month.

How to Get Instant Credit Card Approval :-

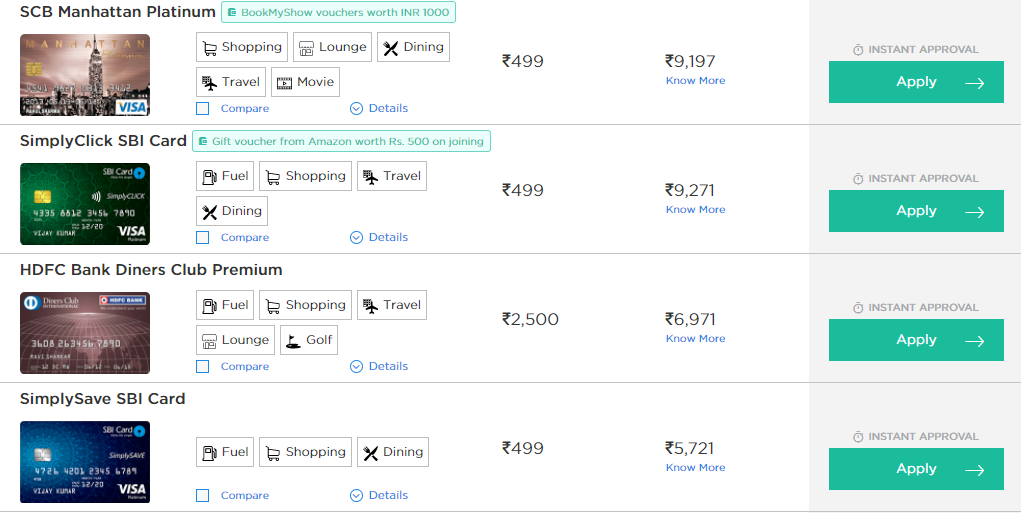

Instead of directly opting some bank’s credit card, use sites like BankBazaar & get the best credit card deal upon your requirement. Bank Bazaar will generate a credit score upon your details & provide you the best Credit Card offer for you

- Visit BankBazaar Credit Card Application from here

- Start filling up the form with your accurate details

- Make sure your Income should be more than 35k per month and Age above 25 years.

- Now Fill in Personal Detail on Second Page to get Instant Credit Card Approval

- BankBazaar will provide you a list of cards suitable for you, most of them will offer you free vouchers of Amazon, Bookmyshow, etc

- Choose the best card suitable for your need & Click on ‘Apply’ Button

- Proceed with the formalities & get instant approval on your credit card.

- That’s it! Enjoy the seamless benefits of a credit card.